Energy, Trade and Finance MSc

Key information

Duration: 12 months

Attendance mode: Full-time

Fees: £29,500 (more information)

Location: Bunhill Row

Start of programme: September 2024

Application deadline: August 2024

Entry year: Showing course information for 2024

A unique multidisciplinary programme, giving you the knowledge and skills in demand by employers.

Overview

Energy, Trade and Finance MSc Who is it for?

You have the equivalent of a UK upper second-class degree, or better, with a solid understanding of quantitative methods (mathematics and statistics). It’s likely that you have a few years’ work experience already, through either an internship or full-time employment. You’ll appreciate the chance to build your professional network with peers from all around the world and business leaders from the global energy, commodity trade, finance and shipping industries.

Why choose this course?

- Study on a unique multidisciplinary programme, acquiring specialised and flexible skills and knowledge in demand by employers across the Energy, Trade and Finance industries

- Design your third term to meet your career goals, with a wide choice of specialist electives and opportunities for research projects, including with the Bank of England, Department for Transport and Maritime UK

- Have the opportunity to join the Energy and Commodities Society, among their activities are producing market reports and organising social events with the participation of practitioners

- Become one of the more than 4,200 graduates of The Costas Grammenos Centre for Shipping, Trade and Finance.

Course objectives

The MSc in Energy, Trade and Finance fully equips you with the skills and knowledge to operate effectively in the highly competitive international energy markets and the commodity trade industry as well as in the wider financial sector.

In this multidisciplinary programme, you’ll gain a solid understanding of energy economics and trading and, in turn, you will learn how to formulate decisions about fossil fuels, electricity and renewables.

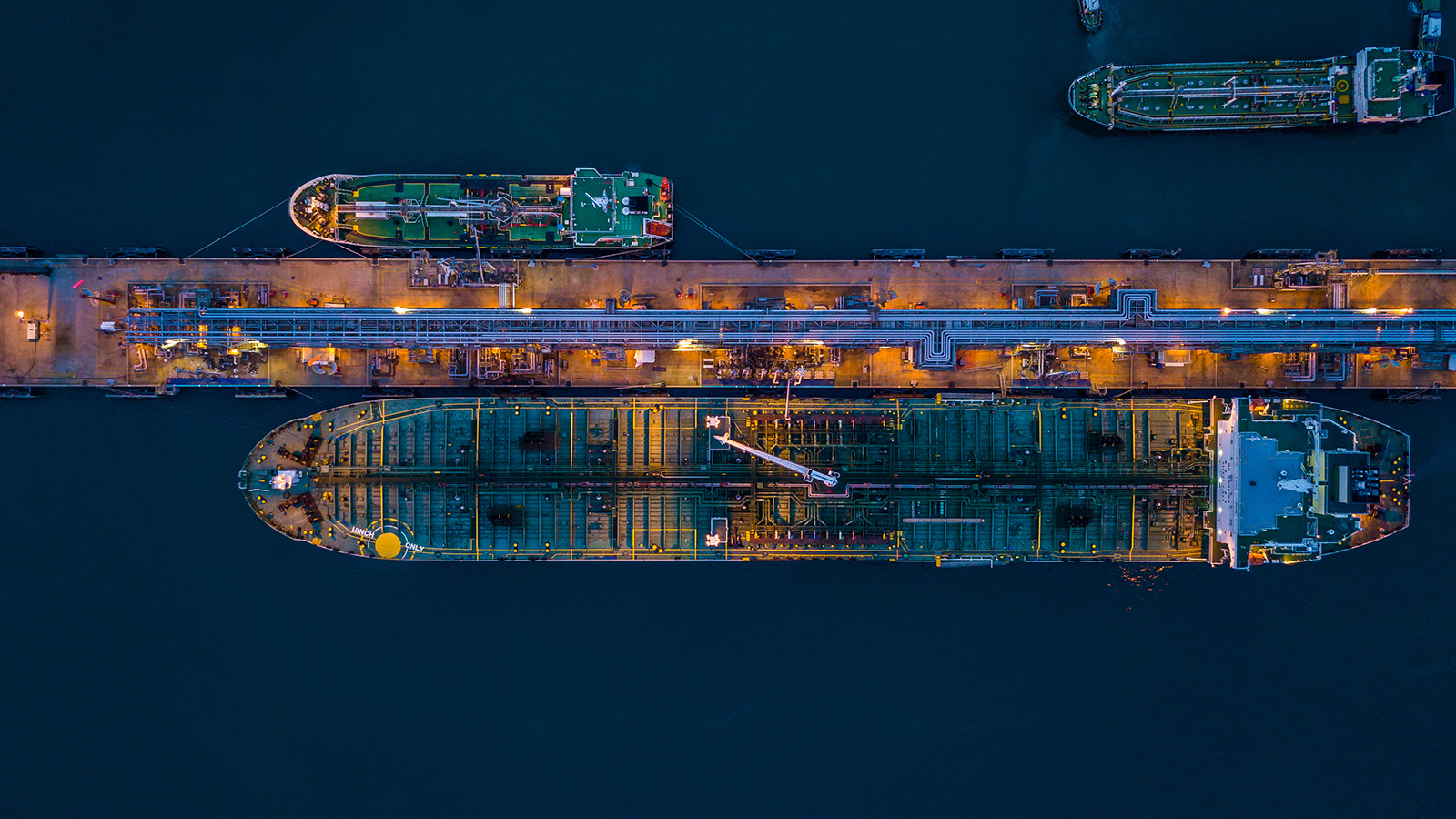

Your studies will encompass energy transportation and logistics, especially seaborne. You will also build a strong foundation in finance and financial markets and develop relevant quantitative, software and accounting skills. You will enhance your research, presentation, and teamworking skills by producing a group business plan related to the fields of energy, trade and finance.

The MSc is offered through the world-renowned Costas Grammenos Centre for Shipping, Trade and Finance whose aims are to:

- Offer high-quality teaching

- Produce high-quality research

- Support international dialogue between academia, industry and government.

You’ll learn from teaching staff with many years of industry and research experience across the areas of energy, commodity trade, shipping, risk management, and finance.

Teaching staff

The teaching staff on the Energy, Trade and Finance MSc programme have many years of teaching and practical experience from the industry and are also active researchers in the related fields.

This knowledge and experience inform the highly interactive lectures that make up this MSc programme.

Accreditation details

This course is accredited by the UK Energy Institute (EI). During the academic year, you have free membership to the EI, receive a free monthly publication and have discounted access to networking events for graduates seeking employment in the energy sector.

The MSc in Energy, Trade and Finance programme is also accredited by the Global Association of Risk Professionals (GARP). GARP is an industry-leading professional association dedicated to preparing individuals and organisations to make better informed risk decisions. The status is granted to top institutions whose degree content incorporates at least 70% of GARP’s Energy Risk Professional (ERP) Body of Knowledge, the first leading and global designation for energy professionals. The academic team works closely with GARP to ensure that our curriculum meets the latest global industry needs.

“We are very pleased to welcome the Business School (formerly Cass), City University of London as a member of GARP’s Partnership for Risk Education. The MSc in Energy, Trade and Finance is a comprehensive, rigorous program that provides its students with strong preparation for pursuing the Energy Risk Professional (ERP) designation as well for a career in the dynamic field of energy risk management.”

William May, Global Head of Certifications and Educational Programs – GARP.

*Please note that all accreditations and exemptions are subject to change. Please check if you have specific requirements.

Course content

On the Energy, Trade and Finance master’s programme, you will:

- Benefit from the insights and practical expertise of teaching staff with hands-on industry experience and internationally acclaimed research, and guest lecturers working in related fields

- Learn on a course that’s accredited by the UK Energy Institute (EI), for which students are offered free membership, and the Global Association of Risk Professionals (GARP)

- Build your connections and experience in the City of London, with links to leading international energy and trading organisations, as well as shipping, finance and banking businesses.

Course structure

Programme content is subject to change. We regularly review our module offering and amend to keep up to date and relevant.

Induction weeks

All of our MSc courses start with two compulsory induction weeks which include relevant refresher courses, an introduction to the careers services and the annual careers fair.

Term 1

Accounting for Managers

- 10 credits

- 30 hours, over ten weeks, in lectures

- 70 hours, over ten weeks, self directed study

Introduces the principles of accounting and finance in business and the main techniques in management accounting, planning and control.

Covers the interpretation and use of annual reports and accounts, financial and ratio analysis, and their use for managerial decision-making, and budgetary control systems.

Energy Economics

- 10 credits

- 30 hours, over ten weeks, in lectures

- 70 hours, over ten weeks, self-directed study

This module provides the fundamental knowledge of energy market economics, upon which the rest of the degree is built. It is one of the four cornerstone modules which define the MSc in Energy, Trade and Finance programme.

Oil and Energy Transportation and Logistics

- 10 credits

- 30 hours, over ten weeks, in lectures

- 70 hours, over ten weeks, self directed-study

The aim of the module is to equip you with tools necessary to think skilfully and maturely, but also independently, on matters relating to the transportation aspects of the energy industry.

Industry trade journals and shipbroker reports contain vast information,

Principles of Finance

- 10 credits

- 46 hours, over ten weeks, in lectures

- 54 hours, over ten weeks, self directed study

To cover essential skills and knowledge in finance that will assist you in gaining an in-depth knowledge in the subject area as it is later taught in Corporate Finance.

The aim of this module is to provide an introduction to the area of corporate finance.

This will be achieved through the development of a common vocabulary and a set of tools that will assist students in gaining a basic understanding of what is corporate finance and it will lay the foundations for further study in this area.

Data Analytics for Shipping, Energy, Trade & Finance

- 10 credits

- 36 hours, over ten weeks, in lectures

- 64 hours, over ten weeks, self directed study

This module introduces the concept of data analytics in the shipping, energy, trade, and finance sectors. In particular, it teaches you how to work efficiently with commodity, shipping, and financial data so as to make data-driven business decisions.

It consists of two interrelated parts: Part 1 is Statistics and Part 2 is Data Analytics Using R.Research Methods and Professional Skills.

- 10 credits

- 45 contact hours

- 55 independent learning hours

Strong research is a key element of development strategy for companies and institutions, large and small.

This module aims to provide a grounding in financial research, particularly financial modelling and information gathering which you will be able to use to support your learning on the rest of your course.

The module will utilise specific training in a financial modelling package in order to provide a strong foundation for the in-depth and specialist teaching and learning of terms two and three of your course.

You will also learn how to gather information through database research, which you will be able to use to support your learning, substantiate your arguments and make assessments about the nature of the evidence you are using.

Finally, you will bring these skills together by working in small groups for the preparation and presentation of a business plan proposal.

Term 2

Advanced Quantitative Methods

- 10 credits

- 26 hours, over ten weeks, in lectures

- 74 hours, over ten weeks, self-directed study

Builds on the knowledge acquired in Quantitative Methods in Part one and focuses on skills required for advanced analysis in areas such as risk management and forecasting.

Corporate Finance

- 15 credits

- 30 hours, over ten weeks, in lectures

- 120 hours, over ten weeks, self-directed study

The aim of the course is to develop an understanding of modern corporate finance so that the corporate manager, the investment banker and the financial analyst will have the conceptual foundations for making informed corporate assessments of key financial decisions.

Financial Markets

- 15 credits

- 30 hours, over ten weeks, in lectures

- 120 hours, over ten weeks, self-directed study

Covers the global economic and financial environment within which business corporations operate. Globalisation and integration of markets for debt, equity and risk management have created new opportunities in the capital formation process, but pose great difficulties in navigating successfully. Where should capital be raised? How does one manage the risks from certain currencies and certain sovereign regions?

In the context of the globalisation of capital markets, considers the structure, functions and performance of financial markets on an international basis and how they facilitate real economic activity; and the role of institutions operating as global intermediaries within these same markets.

Oil and Energy Trading

- 15 credits

- 45 hours, over ten weeks, in lectures

- 105 hours, over ten weeks, self-directed study

This extended module provides the opportunity to focus on issues of particular importance to the specialist field of Energy, Trade & Finance.

Research Methods and Professional Skills

- 10 credits

- 45 contact hours

- 55 independent learning hours

Strong research is a key element of development strategy for companies and institutions, large and small.

This module aims to provide a grounding in financial research, particularly financial modelling and information gathering which you will be able to use to support your learning on the rest of your course.

The module will utilise specific training in a financial modelling package in order to provide a strong foundation for the in-depth and specialist teaching and learning of terms two and three of your course.

You will also learn how to gather information through database research, which you will be able to use to support your learning, substantiate your arguments and make assessments about the nature of the evidence you are using.

Finally, you will bring these skills together by working in small groups for the preparation and presentation of a business plan proposal.

Power and Renewable Markets.

- 15 credits

- 30 hours, over ten weeks, in lectures

- 120 hours, over ten weeks, self directed study

The module focuses on the value chain of electricity, from its sourcing and generation to its supply, including the economics, pricing, policies and other pertinent issues.

The module aims to place environmental and energy policies in context of the power sector, since governmental targets and the integration of renewable energy sources bring new challenges to these relatively new markets.

Professor Michael Tamvakis talks about the Power and Renewable Markets module in this short video.

Term 3

Option 1: Students can take five specialist elective modules (5 x 10 credits).

Option 2: Students can opt to write a 10,000-word Business Research Project (40 credits) and take one specialist elective module (1 x 10 credits)

Option 3: Students can opt to write a 5,000-word Applied Research Project (20 credits) and take three specialist elective modules (3 x 10 credits).

Electives offered in 2023

Please note that electives are subject to change and availability.

- Hedge Funds

- Mergers & Acquisitions

- Ethics, Society and the Finance Sector

- Big Data in Commercial Shipping & Trading

- Business Analytics for Energy, Shipping, Trade and Finance

- Shipping Risk Management

- Trade Finance

Commodity Derivatives & Trading

- 10 credits

- Elective for any of the term three options

The aims of this module are to expand the knowledge already acquired in the area of commodities and commodity derivatives and provide you with the analytical and technical skills required in financing and hedging commodities

Energy Project Investment & Finance

- 10 credits

- Elective for any of the term three options

This elective module provides the opportunity for students to focus on issues of particular importance to the specialist field of valuation of energy projects, investment analysis, and financing oil and gas, refining, power generation, transportation and other segment of the energy industry.

Fintech in Shipping and Energy Trade & Finance*

- 10 credits

- Elective for any of the term three options

This module covers the impact of Fintech and its ecosystem at a high-level, with focus in the areas of Shipping, Trade and Finance. The aim is to stimulate and inspire you towards innovation and entrepreneurship.

Introduction to Python.

- 10 credits

- Elective for any of the term three options

This module is designed to provide a fundamental understanding of Computer Programming with Python and its applications in Finance, utilizing coding and scripting using Python’s Shell and Integrated development Environment (IDLE).

*The Captain Tasos Politis Prize

Every year, since 2021, the Best Fintech Innovation project is awarded the Captain Tasos Politis Prize, which comes with a £1,000 cash award to the winning group of the FinTech in Shipping and Energy Trade & Finance elective. A shipowner, innovator, serial entrepreneur and Pireaeus patriarch, Captain Tasos Politis was a close friend to Bayes Business School, mentor and sponsor to a number of ambitious students in the UK, Europe and Greece.

International electives

- Project Finance and Infrastructure Investment (taught in Madrid, Spain)

- Shipping Company Management (taught in Greece).

More about elective modules at Bayes

See the Energy, Trade and Finance programme specification.

Projects

Business Research Project

It is important for aspiring professionals to demonstrate, on an individual basis, their ability to apply concepts and techniques they have learned in an in-depth study of a topic of their choice and to organise their findings in a report, all conducted within a given time limit.

To train you to undertake individual research and provide you with an opportunity to specialise in a contemporary business or finance topic related to your future career aspirations. You are required to submit a project of approximately 10,000 words on any subject area covered in the Energy, Trade and Finance course.

Among the topics of research interest could be: energy finance and economics; commodity risk management; commodity pricing; exhaustible and renewable sources; demand and supply determinants; transportation; commodity and energy trading; green finance.

A typical project can involve any of the following research methods: extracting data from either electronic databases or/and by hand; statistical analysis of large or small populations; interviews; case studies of an industry or a sector or of a business/finance issue in a particular country setting.

Applied Research Project.

The aim of this module is to enable you to demonstrate how to integrate your learning in core and elective modules and then apply this to the formulation and completion of an applied research project. You will be required to demonstrate the skills and knowledge that you have acquired throughout your MSc studies on the Energy, Trade and Finance programme.

You will undertake a short piece of applied research on a question of academic and/or practical relevance. Among the topics of research interest could be: energy finance and economics; commodity risk management; commodity pricing; exhaustible and renewable sources; demand and supply determinants; transportation; commodity and energy trading; green finance. Based on your chosen topic, you must write a report of around 5,000 words that summarises and critically evaluates your method and findings.

Some of our students are given the opportunity to conduct their research projects (either BRP or ARP) in association with the UK Department for Transport (DfT) or as part of the Masters Programme of Maritime UK or the Research Support Programme of the Bank of England. Upon completion, their findings are presented to senior policy makers and businessmen.

Download course specification:

Energy, Trade and Finance MSc [PDF]Assessment methods

Term dates

Term dates 2024/25

- Induction: 9th September 2024 - 20th September 2024

- Term one: 23rd September 2024 - 6th December 2024

- Term one exams: 6th January 2025 - 17th January 2025

- Term two: 20th January 2025 - 4th April 2025

- Term two exams: 21st April 2025 - 2nd May 2025

- Term three - international electives: 5th May 2025 - 16th May 2025

- Term three: 19th May 2025 - 4th July 2025

- Term three exams: 7th July 2025 - 18th July 2025

- Resits: 11th August 2025 - 22nd August 2025

- Additional resit week - tests only: 25th August 2025 - 29th August 2025.

Timetables

Course timetables are normally available from July and can be accessed from our timetabling pages. These pages also provide timetables for the current academic year, though this information should be viewed as indicative and details may vary from year to year.

Please note that all academic timetables are subject to change.

Fees & funding

UK/Home/International fee

2024 entry

£29,500

Tuition fees are subject to annual change.

Deposit: £2,000 (paid within 1 month of receiving offer and non-refundable unless conditions of offer are not met).

First installment: Half fees less deposit (payable during on-line registration which should be completed at least 5 days before the start of the induction period).

Second installment: Half fees (paid in January following start of course).

Scholarships & bursaries

Scholarships, sponsorships, loans and other funding could support your education at Bayes Business School.

Learn about the cost of living as a Bayes student in London.

Scholarships

We have a range of scholarships for Master's degrees at Bayes Business Scool. Most scholarship applications for 2024/25 year of entry will open in January 2024.

View our scholarships and fundingCareers

Your skills will be of interest to commodity trading houses, oil & gas companies, professional services firms, shipping-related companies and energy and commodity market information providers.

You’ll get advice and support, from the beginning of the course but also as you start on your career, from both our specialist careers team and the academics of the Centre, as well as from the industry contacts you make through our societies and events.

Class of 2022

Recent graduates have secured positions such as:

Job Titles:

- Broker

- Carbon Sales & Marketing Manager

- Procurement Manager

- Business Analyst

- Energy Analyst

- Data Scientist.

(Data provided from alumni who completed the annual destination data survey for 2021/22)

Download our latest MSc Employment Report

Recent employers

Alumni stories

Entry requirements

- A UK upper second class degree or above, or the equivalent from an overseas institution

- Some level of previous study in finance or quantitative methods is preferred

- Work experience is not a requirement of this course.

GMAT

- GMAT is not required for application, but may be requested as a condition of offer at the discretion of the Admissions Panel.

Interview

Applicants selected by the Admissions Panel may be invited to an online interview. We will contact all selected applicants with full instructions after the Admissions Panel has made an initial assessment of your application.

We strongly advise you to provide us with your own personal email address when applying to avoid missing interview deadlines and any important information sent from the Admissions Team.

English language requirements

If you have been studying in the UK for the last three years it is unlikely that you will have to take an English language test.

If you have studied in the UK at degree level for less than three years (e.g. 3+1, 2+1, 2+2, etc.) you will be required to provide the results of an approved English language test and possibly resit the test to meet our academic entry requirements.

Full list of approved English language tests/qualifications and minimum requirements.

Apply

Please see our Application Guide for details of the documents you will need to supply as part of your application, and other useful information.

We cannot comment on individual eligibility before you apply. We can only make a decision on your application once it is fully complete, with all requested information received.

Apply for 2024 entry

We only accept online applications.

Individual Appointments

If you would like to arrange an individual appointment to discuss the application process and be given a tour of the facilities, please complete this form.

Please note - these are subject to availability.

Terms and conditions

Students applying to study at Bayes Business School are subject to City, University of London's terms and conditions.

Student life

We are located right in the heart of London. Being a student at City allows you to take advantage of all that London has to offer.

London is continually ranked as one of the 'Best Student Cities' in the world to study within (QS, 2019).

-

Have a question about student experience at Bayes?

Talk one-on-one with a student who is currently studying at Bayes.

Contact us

Speak to one of our staff from Master's programmes teams.