Five real estate trends to look out for in 2024

The new year will bring fresh challenges to the real estate market but also the possibility of investment opportunities, according to experts in the Real Estate Centre at Bayes Business School (formerly Cass).

“What was widely anticipated to be a sharpening of normal cyclical fluctuations in 2023 turned out to be a complete alteration of the investment environment, with calls for significant capital reallocation between equity and credit, and potentially between real estate and other asset classes,” said Dr Nicole Lux, Senior Research Fellow at Bayes and lead author of the bi-annual Commercial Real Estate Lending Report.

With recent investor battles against volatility and spiralling debt burdens, here is what may happen in the year ahead.

Property values and transactions to fall further?

Despite rising interest rates in Europe, commercial property values are expected to take a further hit in 2024.

“Rising interest rates throughout Europe have materially reduced the premiums of property yield over the long-term government debt, reducing the attractiveness of CRE for investors,” Dr Lux said.

“However, property values are still expected to fall further in 2024 due to many other reasons, such as the much-needed capital expenditures (CapEx) and investment on many properties.

“Interest rates staying higher for longer will be painful for companies and consumers alike, even if recessions are avoided. Banks’ exposure to commercial property will be interesting to see in the year ahead.”

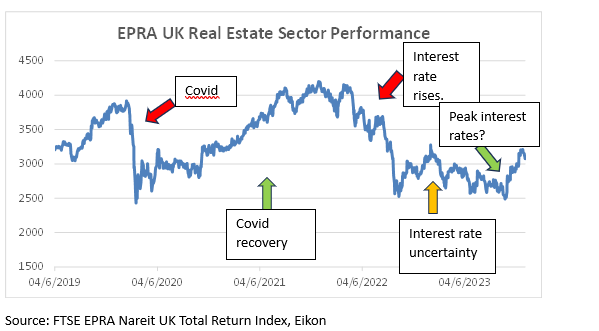

Interest rate stability in the UK could, however, boost listed sector performance

Although value falls are expected to continue in the direct market, this does not necessarily mean that the listed sector will follow the same direction. The equity market is already pricing in these general falls, and will be focussed on the specific “clearing price” established for certain asset types and the future trajectory of interest rates.

“The consensus of brokers, fund managers and companies for 2024 suggests a more upbeat mood among listed sector participants compared to last year,” said Alex Moss, Director of the Real Estate Centre.

“The UK listed real estate sector has already rallied sharply (25 per cent) during the final quarter of 2023, in anticipation of a plateauing of, and a subsequent reduction in, interest rates.

“The hope is that positive news for 2024 hasn’t already been priced in during the last two months of 2023. It is also worth noting that this positive outlook does not apply to all companies. There is expected to be a clear distinction between those companies in a strong position – with long lease lengths, low leverage, sustainable buildings, a positive reversionary profile and fixed rate long-term debt – and those who have legacy assets in unloved sectors that are still looking to sell assets to reduce leverage or avoid refinancing debt.”

Uncertainty over low transaction volumes despite price slump

Lower commercial property prices are yet to yield higher demand. While there are companies that are having to take drastic action to protect their balance sheets by disposing of assets, reducing costs and raising equity, others are biding their time.

“An increasing valuation disconnect between buyers and sellers is eroding the reliability of current property values, which is resulting in a slowdown in transaction volume. We are now in a situation where investors are waiting for the transaction market to restart,” Dr Lux added.

“While struggling organisations may need to take a short-term approach by offloading assets, others are carefully waiting to take advantage of the upcoming opportunity that asset disposal at discounted values will present.”

More positive investor flows and corporate activity

After a period of negative flows, 2024 investor flows (both equity and debt) into the listed sector should be more balanced.

“Specialist funds are always fully invested,” Mr Moss said.

“But generalists who were absent from the sector are beginning to acquire weightings in selected sectors once again – albeit some took profits just before year end – and passive fund inflows will improve if the retail investor sentiment improves.

“One of the reasons that valuations in certain sectors have reached such wide discounts in the last few years has been the presence of shortsellers, particularly in the retail sector. Easy pickings have already been made in specific companies and sub-sectors, and a number of the shortsellers have now moved on to other non-real estate targets.

“Entering the sector are opportunist investors with excellent private equity or private real estate pedigree who can take advantage of cyclical and structural challenges facing listed real estate companies. They have the available capital and have started to dip their toes in the water with small- scale purchases.

“As well as possible public-to-private transactions, further consolidation in the sector is possible. The recent merger of London Metric and LXi to create the UK’s fourth largest REIT is an excellent example of how consolidating two very highly regarded companies can create an extremely attractive, focused, liquid investment proposition.

“It is also encouraging to see public debt markets opening for real estate companies, with the recent Vonovia £400 million, 12-year bond issue in London more than eight times oversubscribed. “

A changing geopolitical landscape that may create additional turbulence

Away from economic threats, there are many global geopolitical and environmental challenges which will affect markets in the year ahead and beyond.

“Political instability has been heightened by renewed conflict in the Middle East, and uncertainty about Europe’s role in responding,” Dr Lux added.

“Furthermore, 2024 is the year of more than 70 major elections around the world including the United States, and most likely, the United Kingdom – encompassing more than half of the global population. Elections generally create market turbulence as speculation mounts and will shine a spotlight on the global state of democracy. This will inevitably shape worldwide markets, which in turn will affect interest rates and commercial property movements.

“Other trends that may heavily impact the real estate sector and wider business community in years to come include Artificial Intelligence and the battle between developers and regulators, the Green Agenda and changing asset class preferences, and the fortunes of private credit firms.”

All quotes can be attributed to Dr Nicole Lux, Senior Research Fellow at Bayes Business School (formerly Cass), and Alex Moss, Director of the Real Estate Centre at Bayes.