Investing in tech companies after the AI ‘bubble’

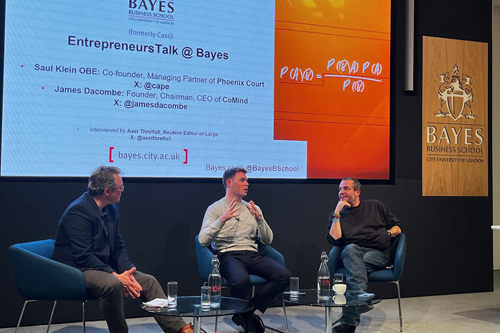

Securing business investment for products that are aided by artificial intelligence (AI) requires being able to prove effective enough use of readily available technologies – according to experts at the latest EntrepreneursTalk@Bayes event hosted by Bayes Business School (formerly Cass).

The series, chaired by Axel Threlfall, Editor-at-Large at Reuters, welcomes guests from entrepreneurial and investment backgrounds to tell their start-up stories, deliver global insights and share advice with an audience of students, alumni and aspiring entrepreneurs. For this latest session, Mr Threlfall was joined by Akash Bajwa, Investor at Earlybird Venture Capital and Anthony Rose, Co-Founder and CEO of SeedLegals for a look at the role of AI and technology in starting-up and growing companies.

The conversation began by exploring fundamentals of pitching a business or product, underlining the importance of selecting the right venture capitalists to approach and telling a compelling story.

The discussion then examined the post-Brexit landscape with experts suggesting the UK still offered a highly attractive investment environment in terms of financial incentives and legalities, while also arguing that Paris had been the main beneficiary of resulting movements in the AI space. The panel also outlined key differences in how a business owner might look to secure investment in Europe compared to the United States, the importance of humility and listening to advice, and the challenges of successfully securing capital in AI-enabled products in the presence of ChatGPT.

Following the fireside chat, Mr Bajwa and Mr Rose answered questions from a lively audience, ranging from how to find the best venture capital fit and determine the ‘value’ of an idea, to how young, inexperienced entrepreneurs can summon the confidence to believe their business idea is both profitable and scalable. A question about the relevance of educational background and experience when seeking investment prompted thoughtful responses, with experts explaining the importance of perceived business trajectory when establishing the credentials of an individual.

Aurore Hochard, Head of Entrepreneurship Programmes at Bayes, said the guests had provided valuable insights and lessons for an eager audience.

“My thanks go to Akash, Anthony and as always, Axel, for providing another hugely enriching EntrepreneursTalk event,” she said.

“The aim of the series is to bring real entrepreneurs and investors together with students and members of our community.

“Anthony has years of experience in setting up and selling start-ups in digital platforming, before co-founding the UK’s largest closer of funding rounds, while Akash is a highly accomplished investor in early-stage funds with some of the brightest young entrepreneurs across Europe. Our audience will certainly take away some excellent words of wisdom.

“At Bayes, we deliver entrepreneurship education both through degree programmes and a fast-track executive education module to help business owners of all shapes and sizes take the next step.

“Our location in the heart of London’s Square Mile enables unrivalled access to many of the UK’s leading start-ups and the people behind them, with students able to take advantage of practical learning, expert mentoring and tailored development programmes.”

The Bayes Innovate conference, an inter-disciplinary event exploring entrepreneurship, innovation and creative leadership will take place in March. The theme of this year's conference is 'Entrepreneurship in the era of AI'.

Further details about the agenda and how to register will be available shortly.

Find out more about Entrepreneurship at Bayes Business School.

Apply to study on one of our MBA-level executive modules in Entrepreneurship.

Find out more about Bayes' entrepreneurship degree programmes.