A Glimpse into the Quantitative Modelling within R Software

It is no exaggeration to say that much of our world is unrecognisable from how it was just a few months ago.

The coronavirus has upended everyday life – how we live, how we work, and how we interact with one another. The vast majority of professional individuals have been mandated to work from home, and the work of the Actuarial, Insurance, Risk and Quant (AIR-Q) society has shifted to mirror this new reality.

As an MSc Quantitative Finance student, being a part of a student society has been an incredibly rewarding experience allowing me to network and immerse myself in the industry I am pursuing. Despite the difficulties of our current working and studying reality, I am proud as Co-president to present another AIR-Quantitative workshop on June 15th through Zoom platform, as a part of ongoing work that our society plans to continue throughout the rest of the academic year and summer.

Hosting an event with a fellow alumna

The event was centred around the work of Olga Ponomarenko. Currently, Olga is a VP Quant at Barclays Bank in London. Her work focuses on implementing and developing advanced statistical models in Python and R. She studied Financial Economics in the joint program of Higher School of Economics and London School of Economics and has a degree in Quantitative Finance from Cass.

As a Cass alumna, she was the perfect person to host an informative workshop on real-world applied statistics, using skills she developed during her time studying Quantitative Finance at Cass. The event hosted over 60 excited individuals who were delighted to catch a glimpse into some of her modelling insights.

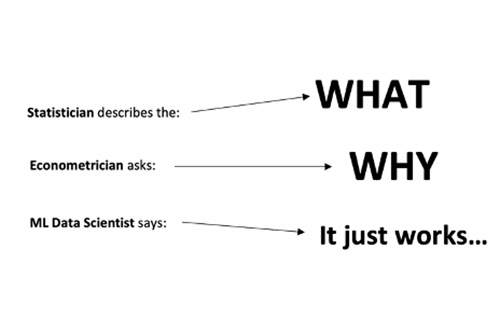

Olga began by polling attendees on which part of the world they had joined the online AIR-Quant workshop. It was a pleasure to see participants from all parts of the world; many from London, across Europe, to North America all the way to India, as well as South and Central Asia. The talk began with a bit of Olga’s professional background. Olga talked about the state of the industry, and in data science, the difference in approach between Statisticians, Econometricians, and Machine Learning Data Scientists.

Olga’s case study: different perspectives to solve the same problem

The bulk of the presentation was centred around a case study. The goal was to demonstrate the many perspectives one can develop from analysing just one simple problem: defining the relationship between recessions and budget deficits. Olga provided World Economic Outlook data on 196 countries and took participants through a variety of techniques to break down the data. She performed naïve and Beta regressions, administered an Arellano-Bond GMM procedure to single out causality, and then applied a Bayesian approach while also displaying the importance of hierarchical models.

Opening up the floor

The presentation ended with a question and discussion period. Olga answered questions on the current state quant jobs in the industry. She gave meaningful advice to participants pondering looming career moves and to those of us soon to be starting our first quant jobs in the industry. She gave great advice on potential interview questions, which programming languages are most desirable for new hires, and specific topics to be aware of before entering any interview in the quant field. She provided us with a primer for interviews in Quantiative Finance, which can be found here. She also took us through a typical day as a Quant at Barclays and proffered the importance of staying up to date on academic literature.

Some participants later joined the discussion to share their journeys into data science – some who began with very little quantitative backgrounds and grew to be successful in their fields. Others shared their favourite programming languages and packages. Overall, the interactive event was enlightening to those of us interested in quantitative disciplines and could not have been hosted by a more qualified and remarkable guest. The Cass AIR-Quant society was delighted to host Olga Ponomarenko, and we look forward to hosting her again in the future as guest for planned AIR-Q Forum Women in Quant Finance.

Thank you!

The Presidents and the founder of the Cass AIR-Q Society Rocio Plasencia, Juan Sebastian De La Torre, Evangelos Santas, Lucy Nondi, David Flanigan, Adam Upenieks and Peter V would like to deliver special thanks to the Cass events team, the participants, and especially Olga Ponomarenko for her remarkable presentation and her insightful view on the continuously changing world of Quantitative Finance.