Bayes academic wins best investment management award for paper

Professor Vasso Ioannidou awarded Best Paper Award for her paper on defined-benefit US corporate pension plans at the 2023 WFA conference

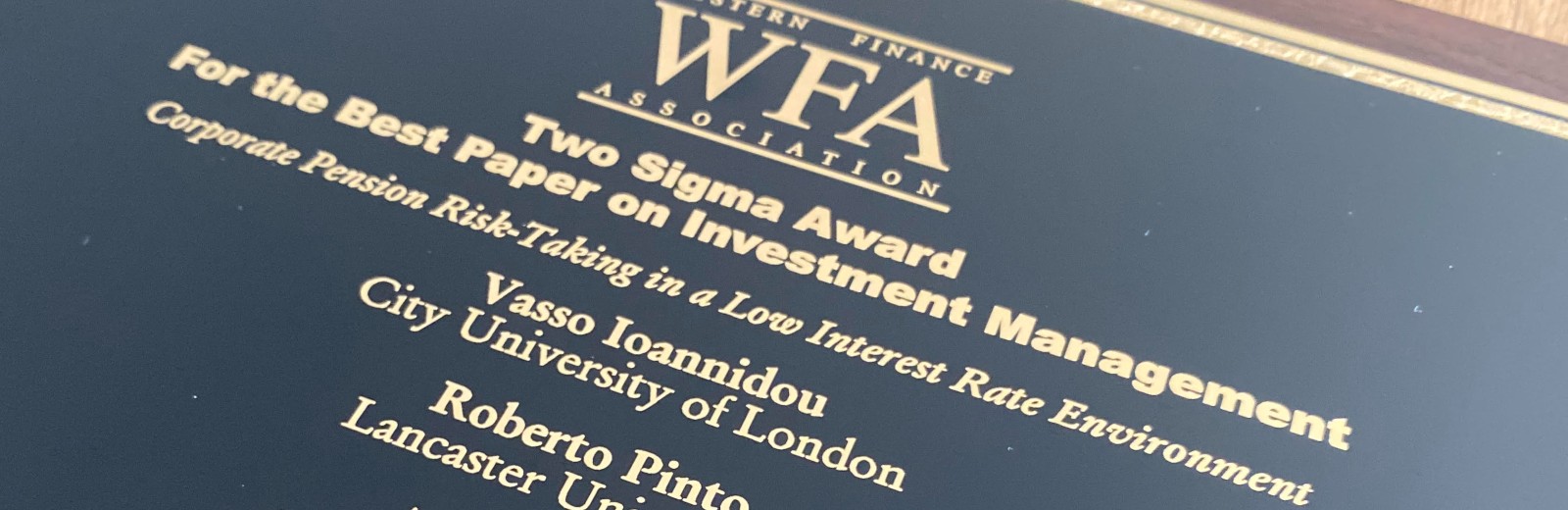

Vasso Ioannidou, Professor of Finance at Bayes Business School, has won the Two Sigma Award for the Best Paper in Investment Management at the 2023 Western Finance Association (WFA) conference in San Francisco.

Entitled “Corporate Pension Risk-Taking in a Low Interest Rate Environment", Professor Ioannidou’s paper, co-authored with Dr Roberto Pinto and Dr Jesse Wang at Lancaster University, studies the effects of low interest rates on defined-benefit US corporate pension plans. The authors find that when monetary policy rates dropped sharply in 2008/09 following the financial crisis, many firms opted for maintaining substantially underfunded plans and invested in riskier assets in a “search for yield”. The authors further show that a regulatory change that reduced the sensitivity of pension plans’ funding status to current monetary policy rates led to a significant reduction in their risk-taking incentives.

The working paper is available on Social Science Research Network (SSRN).

Caption: Professor Ioannidou and her co-authors receive the Two Sigma Award for the Best Paper in Investment Management at the 2023 WFA conference

Speaking about the award, Professor Ioannidou said:

“My co-authors and I are very happy to win this award for our paper. We found that in recent years risk-taking incentives became dominant. As interest rates dropped sharply in 2008/09, many firms opted for maintaining severely underfunded plans and investing in riskier asset classes.

"Our findings suggest this is largely a choice, driven by risk-shifting motives. By extending the horizon over which discount rates are computed, the Moving Ahead for Progress in the 21st Century Act (MAP-21) reduced the sensitivity of DB plans’ funding status to monetary policy. This provided funding relief to sponsors, which in turn reduced incentives to invest in riskier asset classes and freeze their plans, but it also reduced pension contributions.”