Actuarial Capital Modelling for a General Insurance Company

Our Actuarial, Insurance, Risk and Quants (AIR-Q) Society host regular events at Bayes Business School to share insights and updates from speakers in the industry. Their events co-ordinator Kinjal takes us through their recent event which explored the role of capital modelling within the insurance industry.

Hi, my name is Kinjal Dalal and I study MSc Actuarial Management at Bayes Business School. My interest in Actuarial Science peaked while I was already pursuing Chartered Accountancy during my graduation years. I came across actuarial studies and learnt about the application of statistics in their work and found myself wanting to learn more about this profession and wanting to pursue Actuarial Science. This journey has led me to Bayes. The primary areas that interest me in the course are financial and risk management, with an enthusiasm for credit risk modelling and valuing financial derivatives.

The actuarial world has been evolving rapidly in recent years and being able to adapt and learn new skills can give provide a good edge for employment. I aim to bring this advantage to my peers through talks and seminars by speakers from the industry with a focus on latest updates in insurance, finance, quants and beyond as an event co-ordinator for the Actuarial, Insurance, Risk and Quants (AIR-Q) Society.

One of our objectives is to prepare students for the professional world. For this, we held a seminar by Ritika Rustagi, Director at Mazars UK about her career journey and actuarial capital modelling for general insurance companies. The attendees spanned across diverse levels of experience in the actuarial industry from graduates to 1-3 years.

The Speaker, Ritika, introduced the talk by giving a background of her career, which started with a consultant role for Willis Towers Watson (India), and then later progressed through insurance companies and consulting firms to her current post at Mazars UK, totalling to over 10 years of experience in the industry.

In the next section of the seminar, she discussed actuarial capital modelling, what it is and why it is needed.

Why is Capital Modelling needed?

A non-life insurance company is exposed to various forms of risks which may be dependent on external factors. These include market risk, operational risk, underwriting risk, reserving risk, credit risk, etc. Additionally, the liability of the company on account of claims may have an impact over several years. To cushion the company against these risks and to facilitate growth and expansion of new business, the company needs to determine the appropriate amount of capital required.

The speaker explained the model of 3 lines of defence which is used for risk management in an insurance company:

- 1st Line: The company’s business units i.e., reserving, pricing, and capital modelling, claims teams, etc

- 2nd Line: Risk management team which would do model validation according to ORSA and risk appetite frameworks.

- 3rd Line: Group Internal Audit

So, we see that capital modelling is the first line of defence that the company has against risk.

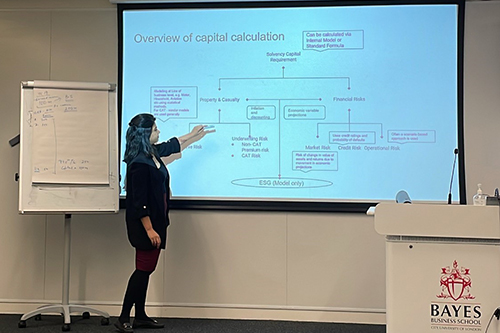

Then, the speaker gave an overview of how the capital would be calculated for the company.

How is Capital calculated?

The liability and asset side are both assessed through evaluating the property and casualty liabilities and financial risks, respectively. This involves looking at how all several types of risks fit together. The liabilities are calculated using statistical techniques such as bootstrapping and using principles prescribed by regulation. The standard capital is calculated for each line of business and then aggregated.

In the later part of this talk, the speaker explained the responsibilities of a capital modeller and a model validator, while talking us through the skills required for these roles. The key obligations of a modeller are designing, testing, analysing, and improving the model. The work also involves use of communication skills to present the model outputs to business heads and liaise with other actuarial teams.

The model validator has a different, but as challenging role which relies heavily on an independent analysis of the work done by the capital modelling team. The results from the model are assessed by a top-down approach, and the model documentation is reviewed by a bottom-up approach.

Towards the end of the session, the participants were able to ask several questions regarding working in the actuarial field, choosing a specialisation and skills needed for the job.

The session overall had been very helpful to understand the workings of capital modelling, and for students to get an idea of the skills and knowledge they would need for their careers. We thank the speaker, Ritika Rustagi for providing these insights and sharing this knowledge.

Follow AIR-Q society to join us for future events:

The founder and presidents of AIR-Q society (Peter V (PhD Actuarial Science), Alistair Lyons (MSc Actuarial Management), Leah Shahzad (BSc Actuarial Science), Chrysovalanto Loizidou (MSc Actuarial Science), Von Ting Yee (MSc Actuarial Science) , Mohammed Rahman (MSc Mathematical Trading and Finance), Mahesh Iyer (MSc Insurance and Risk Management), Jean-Sebastien Verret (MSc Mathematical Trading and Finance), Jasper J. Pittam (BSc Actuarial Science), Shreya N. Totla (MSc Actuarial Management), Kinjal Dalal (MSc Actuarial Management), Flavia Caushi (BSc Actuarial Science) would like to thank Bayes, the Business School careers and events team for their help in setting up a successful event. Many thanks to the participants, and especially the speaker for his knowledge sharing session regarding the acceleration of ESG in the insurance industry. We hope to host such events of high quality in the future.