Why should actuaries care about climate change?

Earlier this term, the Actuarial, Insurance, Risk and Quants (AIR-Q) society was joined by Dr. Louise Pryor and Alasdair Mullins-Smith to discuss the relevance of climate change to actuaries and share how one can make a sustainable impact as an actuary. The AIR-Q society is one of the youngest and the most vibrant student societies at the Business School (formerly Cass) with a strong network of alumni and industry professionals.

I am fortunate to be part of the MSc Actuarial Science cohort at the Business School. I have the opportunity to dive further into topics which interest me, such as tackling climate related risk from the not only the perspective of modelling but also in terms of ethics, management and legal liability.

As a co-president of AIR-Q society shedding light on such an important issue was a priority for me. It is well known that managing risk is the crux of the insurance industry. However, a better understanding of climate-related risks and opportunities should position the insurance industry as a transparent, accountable, and resilient partner in dealing with climate change.

Climate change, sustainability impacts and global warming are such commonly discussed topics, that these terms are rather flippantly thrown around in passing ignoring the weight they hold. With a global pandemic and economic collapse on our doorsteps, climate change is at the forefront of very few people’s minds.

“Climate related risk may be the defining risk of our times.”

Joint Forum on Actuarial Regulation – Risk Perspective 2019/20

The speakers

Both of our speakers are two of the few who haven’t been distracted from or ignorant to such a defining risk:

Louise Pryor

As chair of the London Climate Change Parternship and non-executive director of the Ecology Building Society (alongside her other roles such as IFoA President-elect), Louise is a perfect example of an actuary doing the most to improve awareness for climate risks.

Alasdair Mullins-Smith

While operating as a Senior Manager at PwC, Alasdair is clear proof that contributing to positive change can be done while thriving in your career, as a member of the IFoA Sustainability Practice Board, responsible for international engagement.

The event

The event began by the speakers highlighting the key points of the current situation around climate change and the types of risk involved such as:

- Physical risk – direct impacts from climate change such as storms, floods, health effects, etc.

- Transition risk – risk from adaptation or mitigation such as reputational risk, changes in consumer demands, disruptive technologies, etc.

- Liability Risk – compensation from corporations, or governments, for effects of climate change.

In tackling these risks, we have learnt there are two approaches fit for different issues/risks. Mitigation is about avoiding the unmanageable and adaptation is about managing the unavoidable. As unpredictability increases there will be a multiplier effect causing it to be harder to mitigate bigger issues.

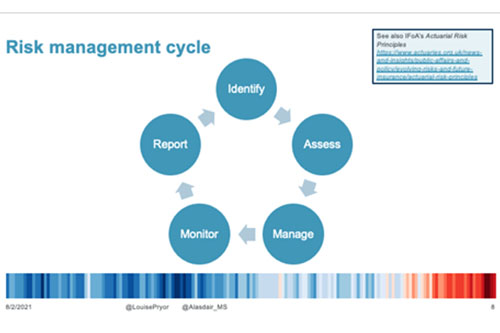

Louise and Alasdair provided a myriad of ways to get involved as an actuary. In tackling such an issue as climate risk one could follow the risk management cycle:

Global examples

We can see how whole nations have applied the climate-related risk management cycle:

- Identify – in the UK done in 60s and 70s and was not taken very seriously by global institutions as there was not enough evidence (similar to the primary responses to COVID-19).

- Assess – the American Academy of Actuaries have a climate risk index to look at metrics such as storms and temperatures.

- Manage – Paris Agreement to adapt by reducing emissions.

- Monitor – governments responsibility to keep an eye on usefulness of current methods and implementation through regulation.

- Reporting – we must constantly be keeping an eye on usefulness of current methods. In the UK there is Mark Carney’s Taskforce on Scaling Voluntary Carbon Markets of large-listed firms have to report climate risk.

Considerations for future

For non-life insurers, the focus is on how it will affect the asset side of businesses who are exposed to transition risk, through methods such as profitability modelling. Even less traditional industries are looking to actuaries to learn from their data for energy modelling, agricultural adaption and scenario analysis.

“A +4°C world is not insurable”

- AXA CEO Thomas Buberl

What is clear is that current actuarial methods will not be sufficient, passed the ‘tipping point’. A world past no return could include unaffordable premiums, systematic risks such as radical economic changes or even climate change traumatic stress.

The speakers emphasised that every actuary must treat climate change as a primary risk. Recent IFoA developments to make sure companies aren’t just ‘green washing’ include:

- IFoA task force for climate change

- Improving awareness of actuaries via regular updates and risk alerts

- Practical guides to help actuaries in ‘traditional’ areas understand how climate change could affect them (a pension scheme may not be useful to someone whose house is underwater)

- Emphasis on the responsibility of an actuary to take long-term systemic risks arising from climate change into account and share it with clients

The speakers ended by sharing a wealth of resources available to further and continually update our understanding of climate risk. Their closing message was clear: just because there is no current “sustainability actuary” position in a standard insurance company, doesn’t mean you can’t be one.

The AIR-Q society was honoured to have Louise and Alasdair share their insights with us, and we would like to extend our sincere gratitude.

The founder and presidents of AIR-Q society (Peter V (PhD Actuarial Science), Harry Parker (MSc Financial Mathematics), Mihir Agarwal (BSc Actuarial Science), Simran Dewani (MSc Actuarial Science) and Siddhesh Surpatne (MSc Actuarial Management)) would like to thank to all participants, and especially the speakers for their knowledge and inspiring message regarding climate change in the actuarial work. We hope to host such events of high quality in the future.

Follow AIR-Q society to join us for future events: