What is the Insurance Company Simulator?

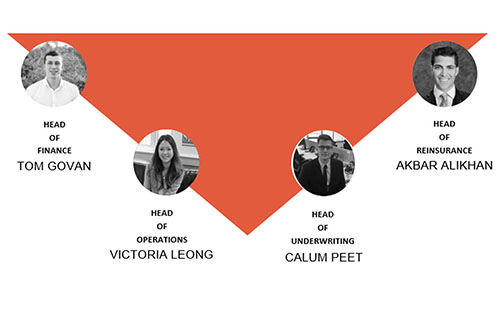

Hi! We're Tom, Calum, Akbar and Victoria, current students on the MSc in Insurance and Risk Management at Bayes Business School.

We recently took part in one of the most interesting and unique aspects of this course, the Insurance Company Simulator and wanted to share our experience with you.

MSc Insurance and Risk Management

Let's start at the very beginning and provide some background on our master's. Developed by Bayes Business School in partnership with the Chartered Insurance Institute (CII), the MSc in Insurance and Risk Management (IRM) explores the growing relationship between insurance, risk management and financial services. The course aims to provide a holistic understanding of the insurance industry with a practical approach, applying all-round skills necessary to thrive in a competitive global business environment. Beginning with the fundamental concepts of Insurance Law, Finance, Insurance Markets and Risk Management, the content builds and finishes with a dissertation.

The Simulator Experience

What is it?

One of the most engaging and unique aspects to the MSc in Insurance and Risk Management is without a doubt the Insurance Company Simulator (ICS). It is an opportunity for students to work in groups and form their own insurance company, learning all aspects of the insurance industry and also the challenges that this presents.

When does it take place?

The ICS forms an integral part of two modules sat in term two: Accounting and Financial Management in Insurance, and Business Strategy and Corporate Governance in Insurance and Financial Services.

A foundation to excel

The ICS allowed us to form our own Insurance company and govern many aspects of the operations, from the investments to underwriting and reinsurance. Not only is this experience incredibly rewarding in terms of gaining a hands-on insight into the operations of an insurer, but it was equally fun and engaging and really solidified the content we had studied in both modules throughout the term. The uniqueness of the ICS experience really allowed us to develop our understanding and ultimately provided us with a very strong foundation to excel when it came to our coursework and examinations.

As a group, having had the opportunity to work together and experience even just a snippet of what was to come, was invaluable. The ICS really solidified the benefits and reasons why we all enrolled on the course to begin with, and not to mention even guiding many to insurance career paths they had not yet considered.

How did it work this year?

The year 2020 impacted the world around us significantly. As with the previous cohorts, we were given different market and environmental conditions for 5 years and we had to adjust our finance and insurance strategy to accommodate those conditions. With our specific cohort however, given all the recent events that have occurred, they modeled the simulation based on the years leading up to the pandemic and a year after.

Our company: Apollo

We named our company Apollo. Each group member was a director of our insurance company. Our company was given a vision and a mission statement and we also developed a corporate culture.

All our decisions for the first 5 years of Apollo reflected our company’s values:

We specifically had made each director responsible for a specific division of the company:

- Head of Reinsurance (Akbar)

- Head of Underwriting (Calum)

- Head of Finance and Investments (Tom)

- Head of Operations (Victoria)

Each person would be doing research for each of these sections on the best strategy for each section and together we would make a decision.

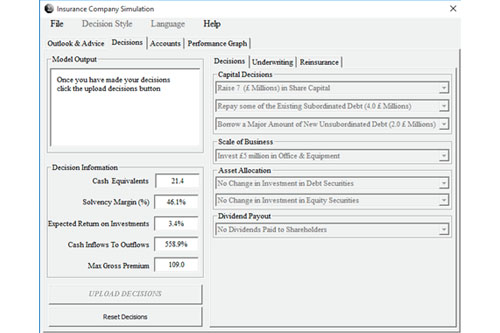

What were we deciding exactly?

We were an insurance company that focused specifically on Motor and Property Insurance for Personal lines. We had to decide how much business we wanted to write for each line of business. We also had to decide how much business in general we would like to write in a specific year given market conditions, how much we would like to reinsure and the type of reinsurance for each line given global activity. We also had the ability to determine how much office and equipment we could invest in. The more office and equipment we invested in, the more staff we would have and the more business we would be able to write. We had to be careful though because we did not want to grow too quickly. There is also the manner of our investment portfolio in which we had to decide how much of each asset type we wanted to invest in.

The simulator scenario results were used for two of our assignments for two different classes. One was for Corporate and Business Strategy and one was for Accounting and Financial Management in Insurance. In the Corporate and Business Strategy coursework we had to create an Annual Report for the 5 years as well as record a Presentation for our “Shareholders” to help them understand and be satisfied with our strategy. The Accounting and Financial Management in Insurance we had to focus more on how our finances were impacted by our decisions.

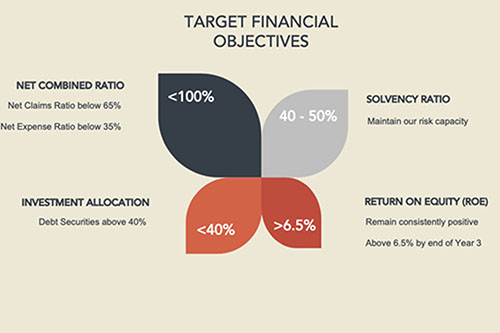

Our objectives

We also set our strategy, along with the financial objectives that would dictate our approach. This allowed us to appreciate the importance of setting these rules and targets, in order to provide focus and unity for the company. They helped us answer questions like ‘should we increase our debt financing during a low interest rate environment?’ Or ‘should we perhaps lean more on reinsurance when we perceive the threat of catastrophes to be higher?’

Finally, these objectives also acted as a good measure of success and failure in the view of our stakeholders, which stresses the importance of stable growth rather than volatile growth. For example, if you could choose to work for two insurers, would you work for the one that could is growing rapidly but could go insolvent over the next few years, or would you choose the one with more stable growth and job security? Clearly there is value-add for stability.

What this experience taught us...

The simulator has given us so many important learnings to successfully operate an insurance company. The first, and possibly most important, is the appreciation for the art of underwriting, and its value in starting an insurance company.

Premiums

Premiums are the lifeblood of an insurer, and so without this, success is impossible. Our role in the simulator was therefore trying to emulate the premium retention and overall underwriting success. The investment side is an ancillary factor; useful in magnifying good underwriting performance or reducing an underwriting loss in a given year.

Alongside this learning, we acquired a holistic understanding of all the technical terms in a balance sheet, income statement and even performance ratios. Performance ratios are rather like checking the pulse in different areas (e.g. capital, investment, underwriting, profitability) which we used to guide and tweak our decision making.

Reflecting on our experience

On reflection, we found our approach was rather aggressive, indicating we were being too bullish with our underwriting, using limited reinsurance, causing strong results in good times, but adverse results in bad times. This is an important learning that simply cannot be read in a textbook!

Our combined ratio told exactly this story, with our ratio exceeding 100% when floods caused our losses to spike. The combined ratio is the fundamental measure of underwriting performance, and should not exceed 100%. For example at 100%, for every £1 of premiums received, the insurer pays out £1 in claims and expenses.

We found that as prepared as you are for your strategy and financial management, you must adapt to changing market conditions. Having a rigid approach will fail to capitalise on opportunities, or fall victim to threats, and so it is paramount to be flexible. As our highlights below show, we sometimes made an underwriting profit (claims and expenses were lower than premiums received), as well as an investment profit, dictating our overall profitability (ROE).

Going forward, this holistic and thorough understanding acquired will be integral for my career going forward. As someone who aspires to be an Underwriter, the lessons learned are invaluable and are my first taste at the challenges and requirements of successfully operating an insurance company.