Uncertainty on the markets “will lead to forced property sales”

Bayes real estate markets expert says dynamic interest rates will cause a headache for lenders and cost recent borrowers on fixed rates.

The Chancellor’s mini-budget has sent shockwaves through markets, with the pound tumbling, and interest rates set to soar as the Bank of England looks to respond.

Among the most affected markets is property, where major lenders are already withdrawing mortgage offers amidst a cloud of uncertainty around borrowing costs. According to Dr Nicole Lux, Senior Research Fellow at Bayes Business School and lead author of the bi-annual Bayes Commercial Real Estate Lending Report, the unpredictability could lead to imminent forced property sales.

Dr Lux said:

“Rapidly changing interest rates are making it difficult for lenders to assess the potential risk of falling property values, or indeed the expected payment difficulties of their borrowers.

“Fixed rate mortgage products have been withdrawn because lenders do not know how to price a five, ten or even 25-year mortgage into the future. While the latest government announcements have led to short-term confusion, it seems pretty certain that long-term low interest rates from the past will not continue in the medium term, and borrowers who bought property and fixed five-year rates between 2017 and 2019 will end up spending more of their household income on mortgage costs.

“Public debt markets have already reacted to increasing interest rates with a sharp drop of new bond issuance, while private debt residential and commercial mortgage providers have been busy running stress tests to consider any additional capital required to cover risks on their lending books.

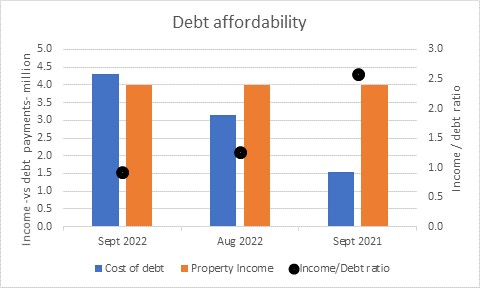

“The five-year Sonia swap rate shows us that debt affordability is already in sharp decline, meaning fewer and fewer people are able to meet repayments. At present rates, a mortgage of 60 per cent loan-to-value (LTV) requires higher interest payments than disposable income available.

“All this will inevitably lead to forced sales amongst commercial and residential property owners, which will play strongly into the hands of capital rich investors who can pick up a bargain.”

All quotes can be attributed to Dr Nicole Lux, Senior Research Fellow at Bayes Business School.